Back in 2012, when I first decided that a career as a professional forex trader is what I wanted to pursue, the forex trading industry in Kenya was very different from what we have today.

- Information was scarce

- local support was non-existent, and

- finding a trustworthy and/or regulated forex broker felt like searching for a needle in a haystack.

Today, however, the industry has changed so much. It has exploded. Every time you scroll online, you’re likely to see an ad promising instant riches from forex trading. The interest is incredible, but so are the risks.

I’ve mentored hundreds of aspiring forex traders in Kenya. I’ve seen incredible success stories, but I’ve also witnessed heartbreaking losses.

And more often than not, the difference between the two comes down to one single, critical decision made right at the very beginning: the choice of a forex broker.

Think of it this way: the forex broker you choose isn’t just a platform; they are your most important business partner.

- They hold your capital.

- They execute your trades.

- Their technology, their fee structure, and their integrity directly impact your bottom line.

Choosing the wrong partner can sabotage even the best forex trading strategy, while the right one can provide the secure and efficient environment you need to thrive.

That’s why I’ve put this guide together. This isn’t a generic list you can find anywhere online. This is my personal playbook/ It is the same unfiltered checklist I share with my mentees to help them settle on the best forex broker for their trading style and capital.

We’re going to cut through the marketing noise and focus on what truly matters when choosing a forex broker in Kenya. My goal is to equip you with the knowledge to choose your partner for the markets wisely, so you can avoid the costly mistakes I’ve seen so many others make. Let’s get started.

#1. Your Broker MUST be CMA-Regulated

This is my non-negotiable, hard-and-fast rule:

I never, ever consider, let alone deposit a single shilling with, a forex broker that is not licensed and regulated by the Capital Markets Authority (CMA).

This isn't a preference; it's the foundation of your safety as a trader.

To illustrate how serious this is, let me give you an example of a case that actually happened.

In 2022, I met a young, sharp trader. She had a masterted using the Smart Money Concepts strategy to trade the GBP/JPY during the Asian session and, amazingly she was consistently profitable on her demo account.

Unfortunately, she was lured by an international forex broker that was promising unbelievably high leverage and a massive deposit bonus.

But the broker was not CMA-regulated, and to make it worse, their regulation information was very scarce.

For a few months, things went well. But when she tried to withdraw her profits, the problems started.

First delays, then excuses, then silence. Her entire six-figure shilling forex account disappeared into the ether, and with no local regulator to turn to, she had no legal recourse. Her forex trading career was over before it even truly began. This is a story I’ve seen play out in different ways too many times.

What is The Capital Markets Authority (CMA)?

The CMA is a Kenyan government agency established under the Capital Markets Act. Its prime responsibility is to regulate and develop fair and efficient capital markets in Kenya, and that mandate explicitly includes online forex trading.

Under the Capital Markets (Online Foreign Exchange Trading) Regulations, 2017, any entity wishing to operate as an online forex broker in Kenya must obtain a license from the CMA.

The law is unambiguous.

Section 23 (1) of the Capital Markets Act states, "No person shall carry on business as online forex broker or hold himself out as carrying on such a business unless he holds a valid license issued under this Act".

When the CMA issues a cautionary statement warning Kenyans against engaging with unlicensed entities because they "risk losing their investments and may not be protected by the law," it's a message that must be taken seriously.

Choosing a CMA-regulated broker is not just about following the rules; it's about ensuring you have the full protection of Kenyan law on your side.

List of CMA Regulated Forex Brokers in Kenya

FXPesa

FXPesa is a solid option for Kenyan retail forex traders, especially those beginning their journey or preferring local deposit methods. The local regulatory licence (CMA Kenya) is a meaningful plus..

Exness

Exness is an exceptional choice for Kenyan forex traders in 2025. It boosts of strong local regulation, unparalleled M-Pesa support, and a technologically advanced trading infrastructure

If a broker trying to win your business is not on this list, your conversation with them should end immediately.

Protections Offered by The CMA to Kenyan Traders

Choosing a CMA-regulated forex broker provides a multi-layered safety net for your trading capital. This goes far beyond a simple license number on a website.

First, Segregated Funds.

CMA-regulated forex brokers are required to keep client funds in accounts that are separate from the company's own operational funds.

This is critically important.

It means that in the unlikely event the brokerage firm faces financial difficulty, your trading capital cannot be used to pay their creditors. Your money remains your money.

Investor Compensation Fund (ICF)

The Capital Markets Act mandates the operation of a compensation fund specifically to protect investors from financial loss if a licensed broker fails to meet their contractual obligations.

In simple terms, if the broker goes bankrupt.

The history of our own capital markets, with the collapse of stockbrokers like Nyagah Securities and Discount Securities Limited, underscores why this fund is not just a theoretical benefit but a tangible protection born from past lessons.

While the compensation is capped (historically at KSh 50,000 for the stock market fund), it provides a crucial layer of security that is completely absent with unregulated brokers

On top of the above benefits and safeguards, some of the best forex brokers in Kenya also offer an additional layer of protection.

For instance, a CMA-regulated broker like Exness is also a member of the Financial Commission, an international dispute resolution organization that has its own Compensation Fund covering judgments up to €20,000 per client.

This creates a powerful dual-protection mechanism: the mandatory local safety net provided by the CMA and a voluntary international one.

A forex broker that is regulated in more than one jurisdiction both demonstrates an exceptionally high commitment to the security of your funds.

Market Maker vs. ECN/STP Forex Brokers – What Your Broker Isn't Telling You

Once you've filtered your list to only include CMA-regulated brokers, the next step is to look under the hood at their business model.

This is something most brokers don't advertise prominently, but it's one of the most critical factors determining the quality and fairness of your trading experience.

There are two fundamental models:

- The Market Maker model and

- The ECN/STP model.

Understanding this distinction is key to understanding your broker's potential conflicts of interest and how your orders are actually filled.

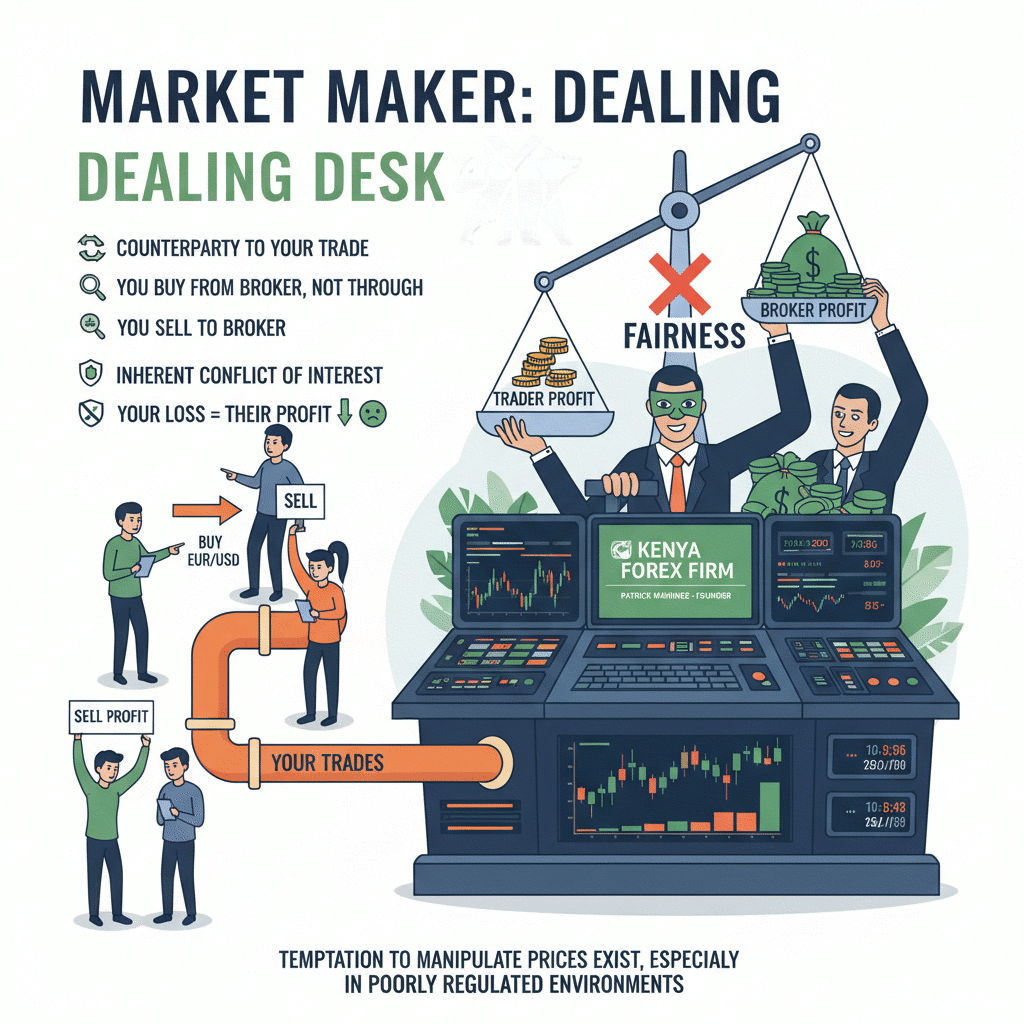

Market Makers (Dealing Desk)

Think of a Market Maker forex broker as a financial "wholesaler" or a forex bureau. They create the market for you.

- They buy large positions from their liquidity providers (the interbank market) and then offer these positions in smaller chunks to retail traders like you and me.

- They make their money primarily from the spread.

The spread is the difference between the buy (ask) and sell (bid) price.

The most important point to understand about a pure Market Maker forex broker is that they operate a Dealing Desk.

They are the counterparty to your trade.

- When you buy EUR/USD, you are buying it from your broker, not through them.

- When you sell, you are selling to them.

This creates an inherent conflict of interest. Because they take the other side of your position, your loss can be their direct profit, and your profit is their loss.

While regulated market makers are required to act fairly, the temptation to manipulate prices or execution to favor the house can exist, especially in a poorly regulated environment.

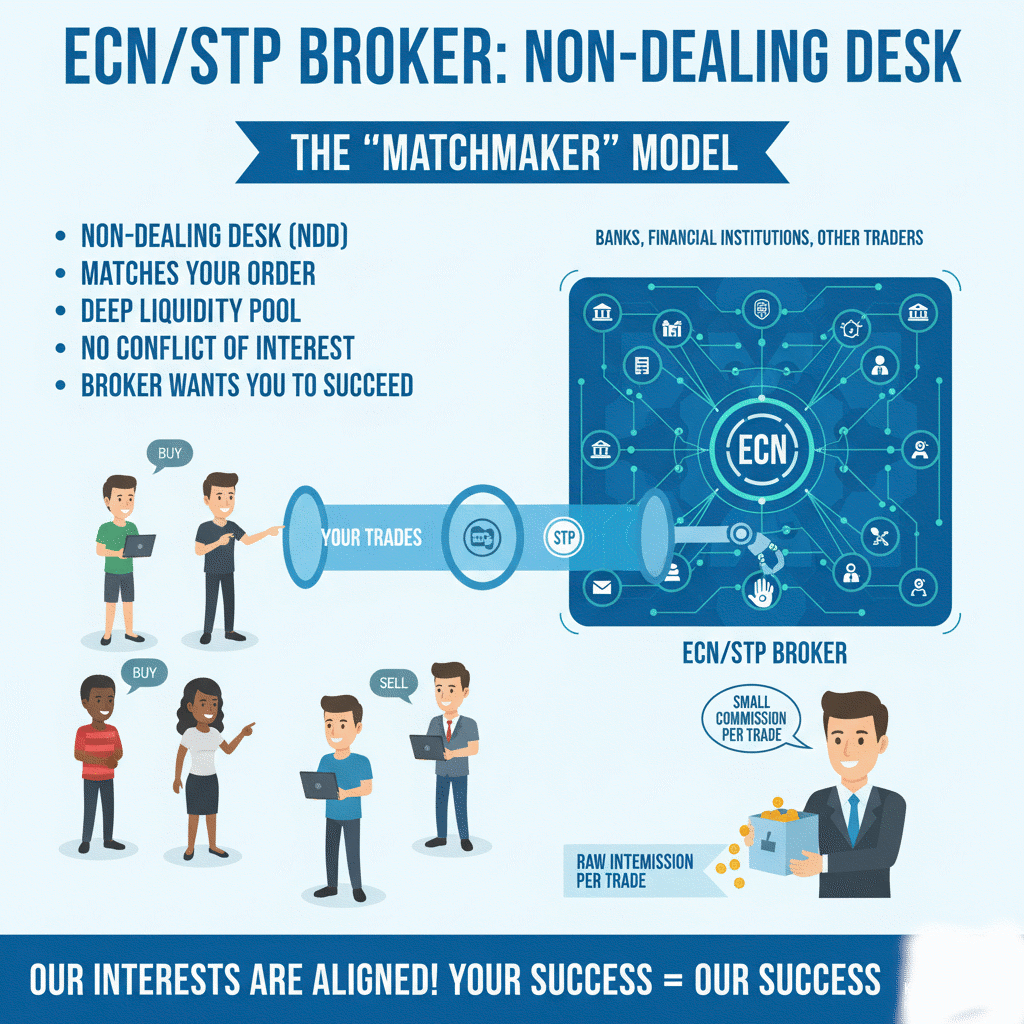

ECN/STP (Non-Dealing Desk)

Now, think of an ECN/STP forex broker as a "matchmaker."

ECN stands for Electronic Communication Network, and STP stands for Straight-Through Processing.

These brokers operate on a Non-Dealing Desk (NDD) model.

Instead of being your counterparty, an ECN/STP broker acts as a bridge. They take your order and pass it directly to a deep liquidity pool, which is a network of banks, financial institutions, and other traders.

The system then automatically matches your order with the best available bid or ask price from this network.

An ECN/STP forex broker doesn't trade against you; their success is tied to your trading volume, not your losses. They make their money by charging a small, transparent commission on each trade in exchange for giving you direct access to raw, interbank market spreads.

The ECN model eliminates the primary conflict of interest. The broker wants you to be a successful, high-volume trader because that's how they earn their commissions. Our interests are aligned. For this reason, it's the model I have personally trusted and used for the majority of my trading career.

The CMA’s own licensing framework provides a powerful clue here. The primary license category for retail forex brokers in Kenya is "Non-Dealing Online Foreign Exchange Broker".

The term "Non-Dealing" itself is an official endorsement of the ECN/STP model, where the broker is not the "dealer" or counterparty to your trades.

By choosing a CMA-regulated forex broker, you are aligning yourself with a business model that is not only recognized but specifically categorized by our local regulator as being client-centric and transparent.

What Fees Are Charged by Forex Brokers?

The Spread

The spread is the most fundamental cost of trading. It's the difference between the buy (ask) price and the sell (bid) price of a currency pair, measured in pips.

If the EUR/USD is quoted with a bid price of 1.0710 and an ask price of 1.0711, the spread is 1 pip. This is the broker's initial profit on your trade.

You'll encounter two types of spreads being charged by forex brokers:

- Fixed Spreads: Fixed spreads remain constant regardless of market conditions. They offer predictability, which can be good for beginners, but they are often significantly wider than variable spreads.

- Variable Spreads: Variable spreads fluctuate based on market liquidity. They can be extremely tight (even 0.0 pips) on major pairs during active trading sessions but can widen during major news events or periods of low liquidity.Most ECN/STP brokers offer variable spreads.

Commissions

Many new forex traders are scared off by the word "commission," but this is a mistake.

Commissions are not inherently bad.

On ECN or "Raw" spread accounts, you pay a commission precisely because the broker is giving you direct access to the raw, ultra-tight interbank spread.

Let's do a simple calculation. Imagine you're trading one standard lot of EUR/USD.

- Broker A (Standard Account): Spread is 1.4 pips, commission is $0. Total cost = 1.4 pips, which is $14.

- Broker B (Raw Account): Spread is 0.1 pips, commission is $3.50 per side ($7 round trip). Total cost = 0.1 pips ($1) + $7 commission = $8.

In the above scenario, the account with the commission is actually $6 cheaper per trade. For an active trader, these savings add up dramatically.

Swap Fees (Overnight Financing)

I often call this the "silent account killer," especially for swing and position traders.

A swap fee is the interest paid or earned for holding a position overnight. It's based on the interest rate differential between the two currencies in a pair. If you hold a trade for weeks or months, these fees can accumulate and eat significantly into your profits or deepen your losses.

This is where a most important feature comes in: swap-free accounts.

Some forex brokers, recognizing the needs of long-term traders or those who cannot pay or receive interest for religious reasons, offer accounts that do not charge overnight fees.

For a swing trader, finding a broker with competitive or zero swaps can be even more important than finding the tightest spread.

Non-Trading Fees

Finally, be aware of other potential costs. These include:

- Deposit/Withdrawal Fees: While many forex brokers offer free deposits, some may charge for withdrawals, especially for international bank transfers. A good broker serving Kenya will offer free and instant M-Pesa transactions.

- Inactivity Fees: Some forex brokers charge a fee if your account is dormant for a certain period (e.g., 90 days).

The "cheapest"forex broker is not a one-size-fits-all title; it is entirely dependent on your trading style.

- A scalper who opens and closes dozens of positions a day for small profits is extremely sensitive to the spread and commission. For them, a Raw ECN account is almost always the most cost-effective choice. The wider spread on a "commission-free" standard account would consume a huge portion of their potential profit on each trade.

- A position trader who holds a trade for three weeks cares far less about a 1-pip difference in the spread. Their primary concern is the cumulative cost of swap fees. A broker offering a swap-free account might be the cheapest option for them, even if the spread is slightly wider.

This is why you must analyze costs through the lens of your own strategy.

To help with this, here is a comparison of the typical trading costs for some of the leading CMA-regulated brokers in Kenya.

What Trading Platforms Does the Broker Offer

Your trading platform is your cockpit. It's where you'll spend hours analyzing the markets, managing risk, and executing trades. It must be fast, stable, and equipped with the tools you need to fly.

The Big Two: MetaTrader 4 vs. MetaTrader 5

For years, the fotrex trading industry has been dominated by two platforms from MetaQuotes software.

I started my own journey on MT4, and it's still a fantastic choice for many.

- MetaTrader 4 (MT4): This is the undisputed industry workhorse. It's renowned for its simplicity, stability, and reliability.If your focus is purely on forex trading, MT4 has everything you need. Its biggest strength is its massive community. There is a vast, time-tested library of custom indicators and automated trading robots, known as Expert Advisors (EAs), built for MT4.

- MetaTrader 5 (MT5): This is the modern powerhouse. While it looks similar to MT4, it's a multi-asset platform built from the ground up to handle not just forex, but also stocks, commodities, and futures.It offers significant upgrades, including more timeframes (21 vs. MT4's 9), more built-in technical indicators (38 vs. 30), and a far superior Strategy Tester for backtesting automated strategies. Its programming language, MQL5, is more advanced, allowing for more complex trading robots.

The Rising Stars: Beyond MetaTrader

While MT4 and MT5 are the industry standards, the best forex brokers now offer an ecosystem of platforms, recognizing that modern traders have diverse needs.

- cTrader: This platform has gained a loyal following for its sleek, modern interface and advanced order management capabilities. It's often favored by scalpers and discretionary traders who appreciate its Depth of Market (DOM) features and clean design.

- TradingView Integration: TradingView is widely regarded as one of the best charting and social trading platforms in the world. Its charts are powerful, intuitive, and packed with tools. A forward-thinking broker will allow you to connect your trading account directly to TradingView, creating a seamless experience where you can analyze and execute trades from a single, best-in-class interface.

- Proprietary Mobile Apps: In Kenya, where mobile is king, a powerful and intuitive mobile app is essential. Brokers like FXPesa (Equiti Trader App) and HFM (HFM App) have invested heavily in developing their own proprietary apps. These apps often provide an all-in-one solution, allowing you to not only trade and monitor your positions but also deposit funds via M-Pesa, contact support, and access market analysis, all from your phone.

A beginner might ask, "Should I use MT4 or MT5?" But a more seasoned trader asks, "What is the broker's entire platform ecosystem?"

The best brokers don't force you into a single choice. They offer a suite of options.

You might conduct your deep analysis on TradingView's powerful desktop charts, execute a trade on your MT5 platform, and then manage that trade from the broker's proprietary mobile app while you're out and about. This flexibility is the hallmark of a modern, client-focused broker and it future-proofs your trading setup as your skills and strategies evolve.

Aligning Your Forex Broker with Your Trading Strategy

A broker's features are meaningless in a vacuum.

"Raw spreads" or "high leverage" are just marketing points until you connect them to a specific trading strategy.

The right broker is one whose strengths align perfectly with your approach to the markets.

Let's look at what different types of traders should prioritize.

For the Scalper & Day Trader

If you are a short-term trader, aiming to profit from small price movements within minutes or hours, your needs are specific and non-negotiable.

- Execution Speed: You need lightning-fast, near-instantaneous execution. A delay of even a few milliseconds can turn a winning trade into a losing one. Look for brokers who boast about their low-latency infrastructure.

- Spreads & Commissions: Your profit margins are razor-thin, so trading costs are paramount. A Raw/ECN account with spreads from 0.0 pips and a low, fixed commission is the only viable option. A standard account with a 1.4 pip spread would likely wipe out most of your potential profits before you even start.

- Platform: A platform like cTrader or MT5 with advanced charting, one-click trading, and Level II pricing (Depth of Market) can provide a significant edge.

For the Swing & Position Trader

If your strategy involves holding trades for several days, weeks, or even months, your priorities shift dramatically.

- Swap Fees: This is your number one cost consideration. The cumulative effect of overnight swap fees can be devastating to a long-term position. Actively seek out brokers that offer swap-free accounts or have very competitive swap rates.

- Range of Instruments: Long-term traders often build diversified portfolios. You'll want a broker that offers a wide range of markets beyond major forex pairs, including commodities (like gold and oil), stock indices (like the US30), and even individual stocks.

- Reliable Mobile Platform: Since you aren't glued to your screen, you need a robust mobile app with reliable price alerts and notifications to keep you informed of major market moves while you're away from your desk.

For the Algorithmic Trader

If you use automated trading systems (Expert Advisors or 'bots'), your broker choice is a technical one.

- VPS Hosting: A Virtual Private Server (VPS) is essential. It's a remote server that runs your trading platform 24/7, ensuring your EAs are always active, even if your home internet or power goes out. Look for brokers that offer a free or subsidized VPS for active clients.

- Platform Power: MT5 is generally superior for algorithmic trading due to its advanced MQL5 language and multi-threaded backtesting capabilities, which allow for faster and more complex strategy optimization.

- No Restrictions: Ensure the broker explicitly allows scalping, hedging, and high-frequency trading strategies without any restrictions.

For the Beginner

If you are just starting your forex trading journey, your primary goal is to learn and protect your capital.

- Demo Account: Never trade with real money until you have been consistently profitable on a demo account for at least a few months. A good broker will offer a free, unlimited demo account that mirrors live market conditions.

- Cent Accounts: This is one of the best tools for transitioning from demo to live trading. CMA-regulated forex brokers like HFM and Exness offer Cent accounts, where your balance is denominated in cents instead of dollars. A deposit of $10 becomes 1000 cents. This allows you to trade with real money and experience real market psychology, but with significantly reduced risk.

- Educational Resources: Look for a broker that invests in your education with high-quality webinars, articles, and tutorials.

My Personal Take on Leverage

You will see some offshore forex brokers advertising leverage of 1:500, 1:1000, or even 1:3000.

Let me be clear: leverage is a double-edged sword.

It is a tool that allows you to control a larger position with a smaller amount of capital, amplifying both your potential profits and, crucially, your potential losses.

High leverage is a tool for experienced forex traders who have mastered risk management.

For a beginner, it is the fastest way to blow up a trading account.

CMA-regulated brokers typically offer more sensible leverage levels, such as up to 1:400, which is more than enough for any sound trading strategy. Start with low leverage (1:100 or less) and focus on consistent strategy, not hitting home runs.

Depost and Withdrawal Methods, Support, and Local Presence

This is where we separate the truly Kenyan-focused forex brokers from the international giants who simply accept Kenyan clients.

For me, a broker's commitment to our local infrastructure is a powerful proxy for their trustworthiness and long-term reliability.

The M-Pesa Litmus Test

In Kenya, M-Pesa is not just a payment option; it's the lifeblood of our digital economy.

If a forex broker operating in Kenya has not integrated M-Pesa for deposits and withdrawals, it's a major red flag. It tells me they haven't done the basic work to understand their target market.

A forex broker that offers instant, free, and seamless M-Pesa transactions demonstrates a genuine commitment to serving Kenyan traders. It removes the friction, delays, and potential high costs associated with international wire transfers or even credit card payments.

Funding, Withdrawals, and KES Accounts

Beyond M-Pesa, look for CMA-regulated forex brokers that allow you to open an account denominated in Kenyan Shillings (KES).

This is a huge advantage. It means you can deposit, trade, and withdraw in our local currency without having to worry about costly currency conversions on every single transaction.

When you analyze a broker's payment options, look at the speed and the cost. The gold standard is instant and free deposits and withdrawals via local mobile money.

Customer Support on Your Terms

Picture this: it's the release of the Non-Farm Payroll report, the market is moving wildly, and you have an issue with your platform. Do you want to be sending an email to a support team in a different time zone and hoping for a reply, or do you want to pick up the phone and call a local Nairobi number?.

The value of having a local support team that understands your context and can communicate in English and Swahili cannot be overstated. It is an invaluable resource when you need help the most.

The Trust of a Physical Presence

In a digital world, a physical address still means a lot. Brokers like FXPesa, which have a physical office in Nairobi (Westlands, to be specific), provide an extra layer of accountability and trust.It shows they have invested in local infrastructure and are not some faceless entity operating from an offshore island. It means they are accessible and are a registered part of our local business community.

These "local" features are more than just conveniences. They are strong signals of a broker's long-term commitment to the Kenyan market. A company that invests in local payment integration, hires local staff, and establishes a physical office is demonstrating that they are here to stay and are accountable to their Kenyan clients.

To help you quickly assess this, I've created a simple scorecard.

Account Opening and Verification Roadmap

You've done your research and selected a broker. Now it's time to get started. The account opening process with any regulated broker is straightforward, but it requires you to complete a mandatory identity verification process known as KYC.

Navigating KYC (Know Your Customer)

Don't be intimidated by KYC. In fact, you should be reassured by it. This process is a global standard required by anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Any legitimate financial institution will require it. A forex broker that lets you open an account and deposit thousands of dollars with no identity check is not a legitimate broker; it's a massive red flag.

The process involves a few simple steps:

- The Online Application: You'll start by filling out a standard online form with your personal details like name, address, and contact information.

- Document Submission: You will then be asked to upload documents to verify your identity and address.

Required KYC Documents for Kenyans

To ensure a smooth and fast verification process, have these documents ready. They typically need to be clear photos or scans.

- Proof of Identity (POI): A valid, government-issued photo ID.

- National ID Card (you will need to upload clear images of both the front and back).

- Passport.

- Driver's License.

- Proof of Residence (POR): A document that shows your full name and physical address, and is typically dated within the last 6 months.

- A recent utility bill (e.g., KPLC, Nairobi Water).

- A recent bank or credit card statement.

- A tax bill or other official government document

Tips for Quick Approval

Verification can take up to 24 hours, but you can speed it up by avoiding common mistakes.

- Clarity is Key: Ensure your photos are high-quality, not blurry, and all text is easily readable.

- Show All Four Corners: Don't crop the document. Make sure all four corners are visible in the photo. This proves the document hasn't been altered.

- Name Consistency: The name on your application must exactly match the name on your POI and POR documents.

- Check Expiry Dates: Your ID must be valid and not expired.

Once your account is verified, you will receive an email confirmation. Only then should you proceed to fund your account using your chosen method, like M-Pesa.

Conclusion: Choosing Your Partner for the Markets

We've covered a lot of ground, and I hope this conversation has armed you with the clarity and confidence to move forward. The journey of a forex trader is a marathon, not a sprint. It's a challenging but potentially incredibly rewarding endeavor that requires skill, discipline, and the right tools. Your broker is the most fundamental of those tools.

As you make your final decision, come back to the core analogy we started with: you are choosing a long-term business partner. This decision will be the bedrock of your trading career.

Let's recap my personal, non-negotiable checklist:

- CMA Regulation: Is the broker licensed by the Capital Markets Authority of Kenya? If not, they are not an option.

- Transparent Execution: Do they operate a Non-Dealing Desk (ECN/STP) model that aligns their success with yours?

- Costs Aligned with Your Strategy: Have you analyzed the spreads, commissions, and swap fees to find the most cost-effective structure for your specific trading style?

- A Robust Platform Ecosystem: Do they offer a choice of reliable platforms (MT4/MT5), excellent mobile apps, and modern tools like TradingView integration?

- The Kenyan Advantage: Have they invested in our local market with M-Pesa, KES accounts, and local support?

Take your time with this decision. Open demo accounts with your top two or three choices. Test their platforms, contact their support teams, and experience their trading conditions firsthand.

Making this first decision correctly and diligently sets a professional tone for your entire trading career. It puts you on a path of safety, transparency, and partnership.

Happy trading, and I'll see you in the markets.